Passenger air traffic in China promises to be the largest in the world within 20 years, according to Boeing, which updated its Commercial Market Outlook (CMO) until 2042.

The outlook in China indicates that the country will have one-fifth of the commercial planes in service in the world, practically the same number as North America.

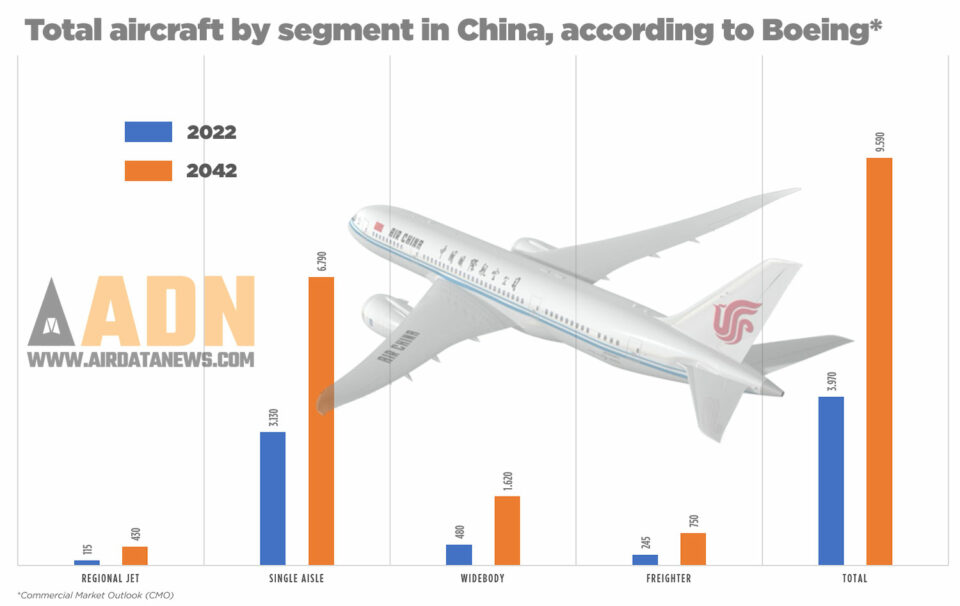

The Chinese air travel market currently has a fleet of almost 4,000 aircraft, but the forecast is that it will reach 9,600 planes in two decades.

Of these, 8,560 planes will be delivered over the next 20 years, Boeing predicts. Single-aisle jets will account for 6,500 units, by far the largest segment according to the US company’s criteria, which separates regional jets, narrowbodies, widebodies and freighters in its calculations.

Widebodies come next, with growth of 238% compared to the 2022 fleet. Currently, Boeing says there are 480 large jets in the country, a total that will reach 1,620 aircraft.

The number of freighters will also be greatly increased, from 245 to 750 planes, while regional jets will increase from 115 to 430 units.

According to the Boeing division, regional jets include aircraft such as the Embraer ERJ and E170/E175, Bombardier (Mitsubishi) CRJ and the ARJ21, from COMAC.

The Chinese aircraft is the first of its type to be produced in series in the country and more than 100 units have been delivered.

Main demand met by Chinese aircraft

“Domestic air traffic in China has already surpassed pre-pandemic levels and international traffic is recovering steadily,” said Darren Hulst, Boeing vice president, Commercial Marketing.

As China’s economy and traffic continue to grow, Boeing’s complete line-up of commercial jets will play a key role in helping meet that growth sustainably and economically.”

Despite Hulst’s optimism, the tendency is for a large part of this demand to be met by Chinese products such as COMAC’s new C919 commercial jet, which is a direct rival to the Boeing 737.

China is also developing a widebody, previously a partnership with Russia, but which should only be launched by COMAC. The aircraft could enter service in the 2030s if the manufacturer can overcome difficulties with a lack of suitable suppliers.

Despite this, Boeing is confident that it can capture part of the massive Chinese market, estimated at US$675 billion in aviation services alone, a sum that makes any political or ideological difference take a backseat.