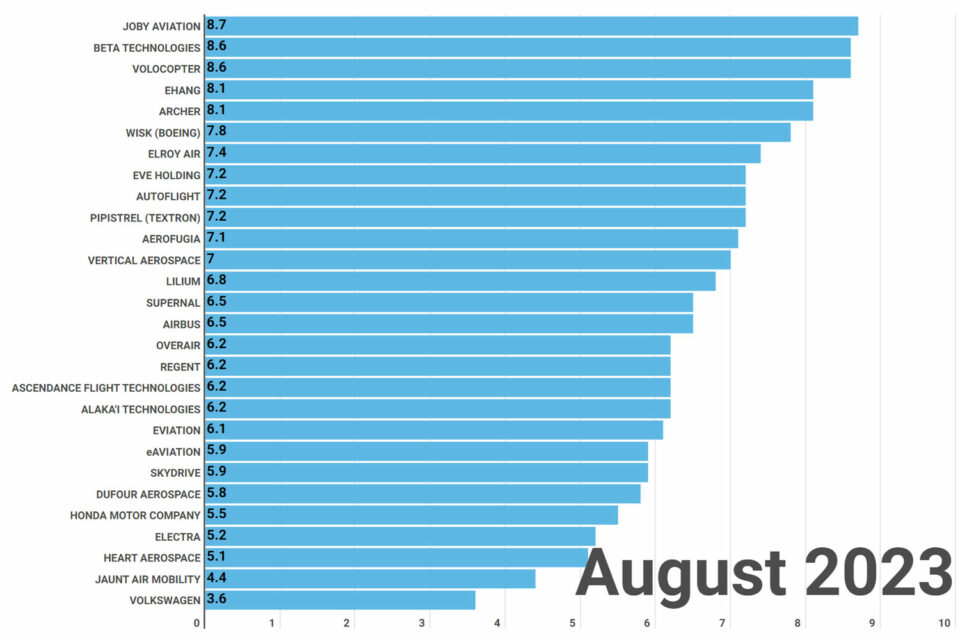

Scheduled to enter in 2025, the eVTOL from start-up Joby Aviation is considered the most promising in the Urban Air Mobility market, according to the Advanced Air Mobility Reality Index (AAM Reality Index), from SMG Consulting.

The ranking, which analyzes various aspects of the development of electric aircraft, is updated monthly by the company and gives Joby a score of 8.7 out of a possible 10.

According to the criteria, to achieve a score of 10, an aircraft must be in series production with a volume of thousands of units, a stage that is still far from the reality of the new sector.

Joby is closely followed by Beta Technologies, Volocopter and Archer (see ranking below).

According to SMG, “the ARI is based on five elements: the funding received by the company, the team that leads the company, the technology readiness of their vehicles, the certification progress of their vehicles, and the production readiness towards full scale manufacturing. ”

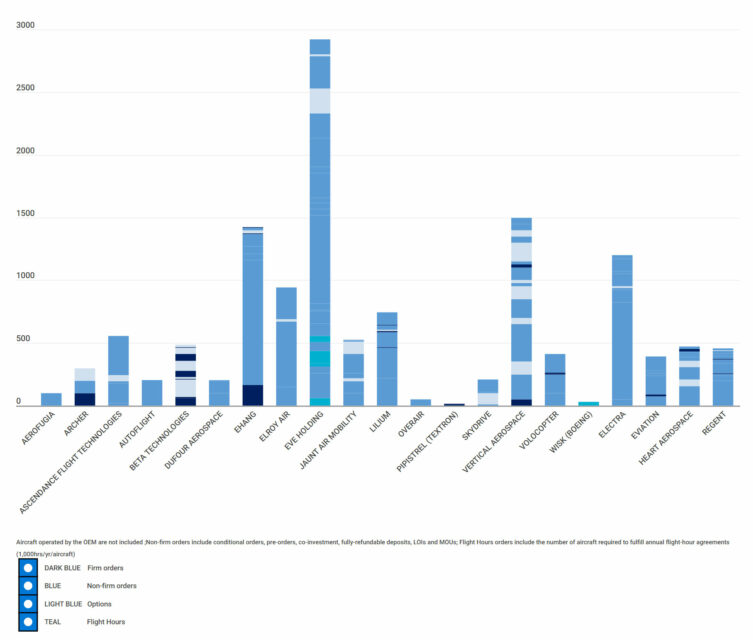

Eve leads in orders

Among so many start-ups from different countries, large aircraft manufacturers appear in a discreet position in the index. Boeing, through Wisk, has an index of 7.8, but there is no known forecast for entry into service.

Airbus, in turn, has an index of 6.5 and plans to carry out the inaugural flight of its aircraft in 2024.

Follow ADN: Instagram | Twitter | Facebook

Embraer, through its subsidiary Eve, comes in 8th position, with 7.2 points, alongside AutoFlight and Pipistrel (Textron). The Brazilian company, however, is the one with the most orders for eVTOLs: there are, so far, 2,850 orders.

The second place in the ranking, the British Vertical Aerospace, has exactly half of Eve’s orders: 1,425 orders for the VX4 model.

In third place comes the Chinese company EHang, which has 1,256 orders for the 216, a small eVTOL for just two occupants.

The order numbers presented in the AAM Reality Index consider firm orders, letters of intent to purchase, purchase options and commercialization of flight hours (SMG considers one aircraft for every 1,000 flight hours per year).

For manufacturers, the most interesting point is the firm order, which is when the sale of the product to the customer is confirmed.

In the clash between Eve and Vertical Aerospace, the second company has an advantage with 75 firm orders for eVTOLs, while Embraer’s affiliate is still at zero in this regard.

Instead, the Brazilian company has several agreements on purchase intentions, options and sales of flight hours. In agreements like this, customers make refundable deposits to enter a delivery queue and subsequently confirm (or not) the acquisition of the aircraft.

SMG claims that its index aims to show the real commitment of a company to deliver a product to the market. “It is not meant as an endorsement or a criticism of any specific company, but as a simple, easy-to-use guide to the complexities of the AAM industry,” explained the consultancy on its website.